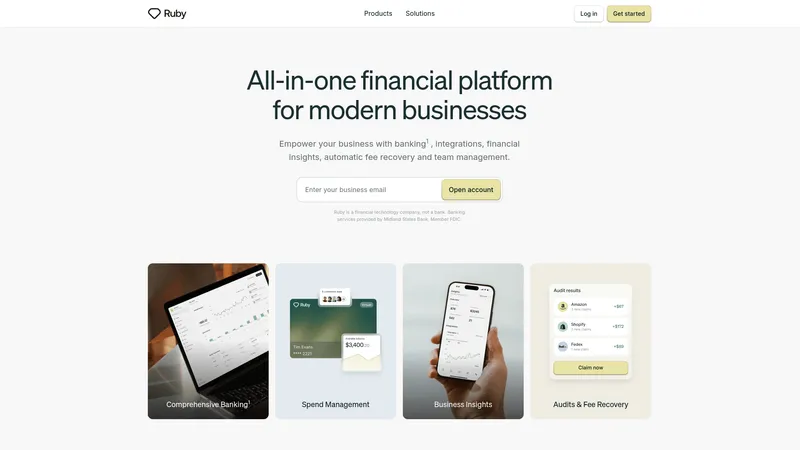

Ruby

2024-08-30

Ruby is a comprehensive financial operating system tailored for modern businesses, offering seamless banking, automated chargeback resolution, and robust spending management solutions. Start optimizing your financial operations today.

Categories

AI Tools DirectoryAI Education Assistant

Users of this tool

Small business ownersE-commerce entrepreneursEnterprise financial managersFreelancers and independent contractorsFinance teams in growing startups

Pricing

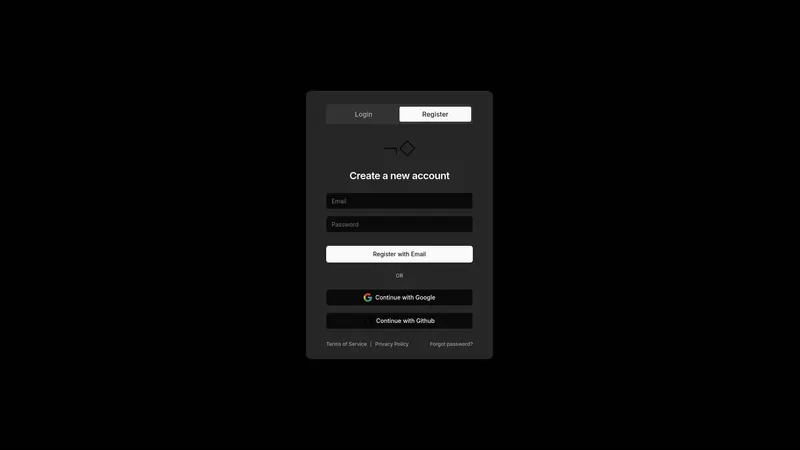

Free tier with limited featuresPay as you go for Bank transactionsSubscription for enterprise solutions

Ruby Introduction

Ruby is an all-in-one financial operating system designed to empower modern businesses with a comprehensive suite of financial solutions. Positioned as a financial technology company rather than a traditional banking institution, Ruby partners with Midland States Bank to provide an array of banking services. Targeting small businesses, growing startups, and enterprise-level organizations, Ruby aims to streamline financial operations and enhance business efficiency. Its core features encompass banking, spend management, analytics, account payable, chargeback resolution, and audits and reimbursements. Ruby focuses on data-driven insights, enabling businesses to make informed decisions while optimizing their financial management. The user experience is crafted to be intuitive, with an integrated platform that allows easy navigation and centralized control of finances across various platforms. With strong security measures such as fraud protection and two-factor authentication, Ruby prioritizes the safety of its users' financial data. Moreover, Ruby emphasizes support and accessibility, enabling customers to connect with their tools and services seamlessly. The platform is built for resilience in fluctuating market conditions, helping businesses thrive through automated financial insights and powerful tools designed to improve transaction efficiency. Ruby invites users to take charge of their financial health with confidence, ensuring they can focus on growth and scalability in an ever-evolving business landscape.

Ruby Top Features

- Comprehensive banking solutions

- Automated chargeback resolution

- Centralized financial insights

- Seamless invoice management

- Integrated accounting

- Granular spend management

- Vendor reimbursement recovery

- Fraud protection and account security

- 24/7 customer support

Ruby Usecases

- A small business owner uses Ruby to manage their invoices and ensure timely payments while tracking all expenses seamlessly.

- An e-commerce entrepreneur integrates Ruby to automate chargeback resolutions, saving time and recovering lost revenue effectively.

- A finance manager at an enterprise-level company leverages centralized insights from Ruby to make real-time financial decisions and improve efficiency.

- A freelancer utilizes Ruby for easy account management and tracking expenses incurred during project work, ensuring accurate reimbursements.

- The finance team in a growing startup automates their accounts payable process with Ruby, streamlining vendor payments and enhancing operational efficiency.