VC Hunt

2024-09-05

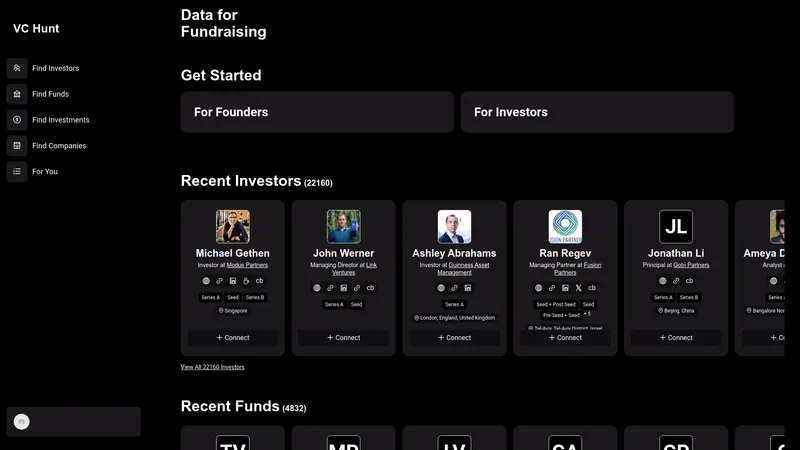

Discover how VC Hunt bridges the gap between entrepreneurs and investors. Find funds, investors and investment opportunities easily, making your fundraising process efficient and successful.

Catégories

Site WebNo-Code&Low-Code

Utilisateurs de cet outil

Startup FoundersVenture CapitalistsAngel InvestorsBusiness Development ManagersFinancial Analysts

Tarification

Free basic accessPremium access with additional features

VC Hunt Introduction

VC Hunt is a dedicated platform designed for connecting startups with investors and investment opportunities in the venture capital space. Its primary positioning is to serve as a bridge between founders in search of funding and investors looking for promising ventures. The target audience includes startup founders, venture capitalists, angel investors, and anyone engaged in the fundraising ecosystem. Core features of VC Hunt revolve around its ability to help users find potential investors, investments, and funds, thus facilitating efficient fundraising processes. The content on the website is structured to guide users in utilizing these features effectively. User experience is optimized with easy navigation and clear pathways for both founders and investors to access needed information swiftly. The technical framework of the website is designed to ensure a seamless experience, focusing on reliability and performance. Other salient aspects include a proactive support system, depicted by the personal touch of the founder offering direct communication for custom features or issues, highlighting the website's commitment to user satisfaction.

VC Hunt Fonctionnalités principales

- Search for investors

- Search for funds

- Investment tracking

- Company profiles

- Personalized recommendations

VC Hunt Cas d'utilisation

- A startup founder uses VC Hunt to identify potential investors who focus on their industry, leveraging advanced search filters to narrow down options.

- An investor visits the site regularly to explore recently added funds, enabling timely investment opportunities in promising startups.

- A venture capitalist tracks investment opportunities using VC Hunt's company profiles, assessing potential partners and their funding rounds.

- A business development manager analyzes market trends by reviewing the funds available on VC Hunt to connect with relevant startups.

- A financial analyst utilizes the platform to prepare reports on investment activity trends and emerging companies, providing insights to stakeholders.